Cryptocurrency

Crypto Market Drops Again: Does Bitcoin Price Risk Fall to $2,500?

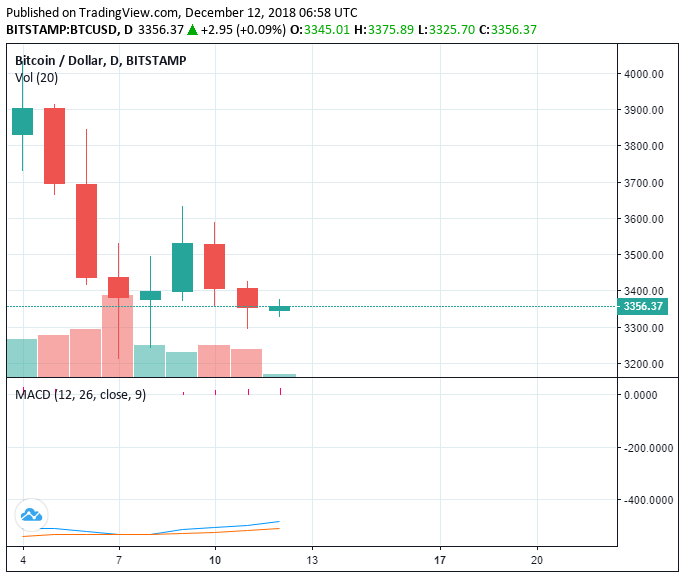

Throughout the past three days, the Bitcoin price has demonstrated wild volatility in the range between $3,200 to $3,600.

The dominant cryptocurrency has struggled to break out of the $3,700 resistance level which several technical analysts have consistently mentioned over the last two weeks.

On December 12, the price of Bitcoin (BTC) fell by around three percent from $3,427 to $3,325 with a relatively low daily trading volume at $4.7 billion. Earlier this month, the daily volume of BTC hovered at around $6 billion.

The continuous fall in the price of BTC without a spike in its volume shows that the asset is declining in value without significant sell-pressure.

Where is Bitcoin Heading

Josh Olszewicz, a cryptocurrency trader and technical analyst better known for his online alias “BrotoshiMoku”, said cautiously that Bitcoin is at a risk of dropping to $2,500 if it cannot sustain any momentum in the short-term.

But, there also exists a possibility of the asset potentially surpassing major resistance levels and entering the $4,000 region and the analyst said that the decline in sell volume of the currency could allow it to engage in a corrective rally in the upcoming weeks.

He wrote:

“This is many weeks away from completing and will likely be wrong. But, if the pattern completes, bull entry at $4,300 other option is bearish 3rd drive down to $2,500 and then retrace to $3,600.”

It is difficult to predict the short-term trend of an asset in a highly volatile period and during a bear market because a minor factor could easily sway the price trend of the asset.

Historically, Bitcoin has tended to experience a major drop in the range of 80 to 85 percent prior to engaging in a several-month-long consolidation period and if it can establish a proper bottom at $3,000, a support level it has held up relatively well since late last month, a gradual climb to $4,000 is possible.

Bitcoin is Not Going to Zero

Mike Novogratz, a billionaire investor and the founder of Galaxy Digital, said that Bitcoin is at a phase wherein pessimism and fear are dominating the market.

He said:

“That was a drug, and I don’t say that lightly. When you’re in the speculative mania, testosterone is boiling over and there’s a lot of greed. The audience is more sober now—the drug is gone. If anything we’re on the other side, at the stage where there’s the pessimism, and the fear, and the ‘Oh my God, it’s going to zero.’ But it’s not going to zero. We’re at the methadone clinic.”

In the short-term, because the demand from the public has declined and the speculation towards the asset has somewhat stabilized, Novogratz said that the market could remain quiet for several months.

However, he emphasized that his company and his team are ready to wait out until the next wave of investors, users, and companies arrive, which he sees as inevitable.

Featured Image from Shutterstock. Charts from TradingView.

-

How to3 weeks ago

How to3 weeks agoHow to Check if Your Tax Consultant E-Verified Your Return Properly

-

Health3 weeks ago

Health3 weeks agoWhat Happens When You Drink Black Coffee Every Day for 30 Days?

-

Technology3 weeks ago

Technology3 weeks agoPerplexity AI Now on WhatsApp: Ask Questions, Get Summaries, Generate Images & More

-

Money3 weeks ago

Money3 weeks agoJSW Cement IPO Opens: GMP, Price, Subscription Status, Review & Should You Invest?

-

![ChatGPT 5 Launched: Who Can Access It, How to Use It & Is It Free? [2025 Guide]](https://www.regularstation.com/wp-content/uploads/2025/08/2DAdWvVdE7ivGpRiqcLMfU-400x240.jpg)

![ChatGPT 5 Launched: Who Can Access It, How to Use It & Is It Free? [2025 Guide]](https://www.regularstation.com/wp-content/uploads/2025/08/2DAdWvVdE7ivGpRiqcLMfU-80x80.jpg) Technology3 weeks ago

Technology3 weeks agoChatGPT‑5 Launched: Who Can Access It, How to Use It, and Is It Free?

-

Cryptocurrency3 weeks ago

Cryptocurrency3 weeks ago5 Cryptos That Could Challenge Solana (SOL) And Grow Your Portfolio 5000% In 2025

-

Health3 weeks ago

Health3 weeks agoCoconut Water Isn’t for Everyone: 6 People Who Should Avoid It

-

Health1 week ago

Health1 week ago5 Best Protein Sources for Vegetarians and Non-Vegetarians