Cryptocurrency

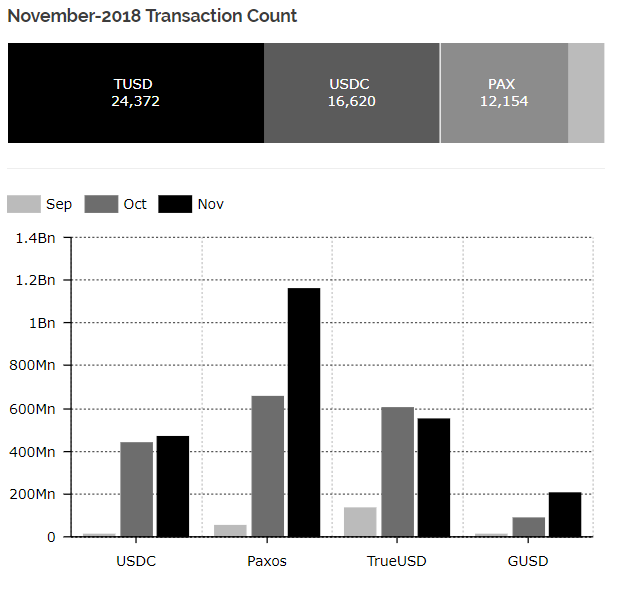

Stablecoin Transactions Increase 1,032% in November

Recent exchange listings have helped Tether competitors gain traction.

2018 rapidly became the year of the stablecoin with numerous dollar-pegged coins launching to compete for market share with Tether (USDT).

According to a recent report by market research firm Diar, the adoption of the major stablecoin alternatives, including USD Coin (USDC), True USD (TUSD), Paxos (PAX) and Gemini USD (GUSD), has accelerated in the previous three months as on-chain transactions jumped a whopping 1032% between October and November.

The four stablecoins have seen more than $5 billion in on-chain transactions within a short 3-month period. While TrueUSD saw a decrease in transaction value, the number of transactions still increased from October to November.

The report does not dive into the exact cause of the surge in on-chain transactions, but it is likely partially due to increased adoption by major cryptocurrency exchanges.

Most recently, Bitfinex, one of the world’s leading cryptocurrency exchanges, and its Ethereum-based decentralized exchange, Ethfinex Trustless, are now offering the six leading stablecoins.

This news came shortly after Binance announced the renaming and expansion of its Tether market to USDⓈ, which now includes a variety of popular stablecoins with an expanded assortment of trading pairs.

-

How to3 weeks ago

How to3 weeks agoHow to Check if Your Tax Consultant E-Verified Your Return Properly

-

Health3 weeks ago

Health3 weeks agoWhat Happens When You Drink Black Coffee Every Day for 30 Days?

-

Technology3 weeks ago

Technology3 weeks agoPerplexity AI Now on WhatsApp: Ask Questions, Get Summaries, Generate Images & More

-

Money3 weeks ago

Money3 weeks agoJSW Cement IPO Opens: GMP, Price, Subscription Status, Review & Should You Invest?

-

![ChatGPT 5 Launched: Who Can Access It, How to Use It & Is It Free? [2025 Guide]](https://www.regularstation.com/wp-content/uploads/2025/08/2DAdWvVdE7ivGpRiqcLMfU-400x240.jpg)

![ChatGPT 5 Launched: Who Can Access It, How to Use It & Is It Free? [2025 Guide]](https://www.regularstation.com/wp-content/uploads/2025/08/2DAdWvVdE7ivGpRiqcLMfU-80x80.jpg) Technology3 weeks ago

Technology3 weeks agoChatGPT‑5 Launched: Who Can Access It, How to Use It, and Is It Free?

-

Cryptocurrency3 weeks ago

Cryptocurrency3 weeks ago5 Cryptos That Could Challenge Solana (SOL) And Grow Your Portfolio 5000% In 2025

-

Health3 weeks ago

Health3 weeks agoCoconut Water Isn’t for Everyone: 6 People Who Should Avoid It

-

Health1 week ago

Health1 week ago5 Best Protein Sources for Vegetarians and Non-Vegetarians