Cryptocurrency

Ethereum Price Surpasses Bitcoin Cash for First Time Ever

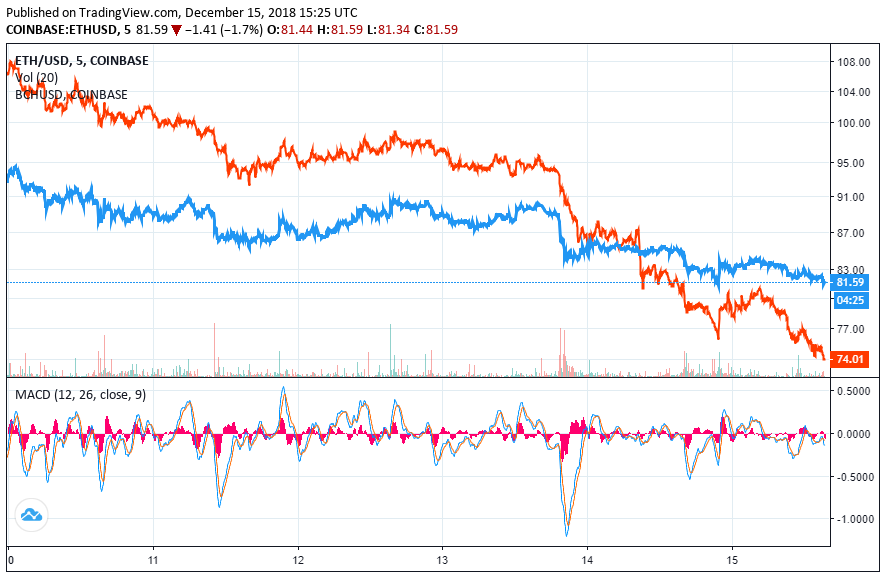

The price of ether has surpassed that of bitcoin cash for the first time ever, becoming the latest negative milestone in a tumultuous few weeks for the world’s fourth-largest cryptocurrency by market capitalisation. According to data from CoinMarketCap, Ethereum traded at $85.51, while bitcoin cash traded at $82 at press time.

Bitcoin Cash Post-Fork Woes

Following the contentious bitcoin cash fork which culminated in a hash war that gave birth to BCH ABC and BCH SV, bitcoin cash has been one of the biggest losers in the crypto market over the past month, first dropping from its post-fork price of $200, then dipping into double digits for the first time before eventually falling behind ethereum as well. The instability sparked by the hash war is also widely credited with being at least partially responsible for the end of year crypto market rout that has seen bitcoin threaten to break $3,000, with practically all major cryptocurrencies down at least 90 percent from their all time high valuations.

Last week CCN reported that in the aftermath of the hash war, bitcoin cash has continued its downward trajectory more than a month after the fork, falling to its current price level from its pre-fork value of nearly $500. Embarrassingly for the cryptocurrency, Bitcoin SV which lost the BCH exchange ticker to the ABC fork actually surpassed it earlier in the month before falling away to its current price of $77 at press time.

In addition to an 81 percent drop in the space of a few weeks, bitcoin cash is also facing a lawsuit by United America Corporation, a Florida blockchain technology company which alleges that the aggressive and strategic deployment of hashing power during the fork constitutes a hostile takeover of bitcoin cash by Roger Ver‘s Bitcoin.com. According to the lawsuit, a “poison pill” has been planted in the blockchain that effectively gives centralised control to Bitcoin.com by giving it power to make decisions of future upgrades and implementations.

Whispers about the alleged centralisation of bitcoin cash continue to circulate in the wake of an article published by a BCH developer last month which accused the blockchain of creating a mechanism for centralisation through the deployment of checkpoints in the wake of the hard fork. According to the pseudonymous developer, it is now possible for permissionless innovation on the platform to be sidelined in favour of wormhole, which violates the basic principle of bitcoin as a decentralised and trustless network.

Featured image from Shutterstock.