Money

Retirement Planning: How to save Rs 1 crore for your golden years

Retirement planning is difficult. Not because it involves heavy number crunching, but because of uncertainty associated with factors such as growth of economy, inflation, returns from investments, and rising medical expenses. Therefore, you need to tread with extra care so far as your retirement planning is concerned. It does not need to be emphasized that whatever money you save or invest today will make your life easier in the sunset years.

Hence, before doling out advice on how to build a corpus for retirement, I will advise you to make it a non-negotiable discipline to put the first cut into your retirement planning. You can postpone all other expenses and outflows, but not this one. Today the situation has changed dramatically, quite unlike in the past, where our parents worked in a single government or private company with regular government-mandated provident fund.

Is the Rs 1-crore figure a mirage?

Investors are quite often unsure about how much they need for a comfortable retirement. The Rs 1 crore is the magic figure that is often talked about in India. But before we answer this question, we need to understand that the golden rule of retirement planning is that no amount is big enough for retirement. You have, in fact, to incur medical expenses, face the rising inflation, and many other unknowns that require money.

Hence, below are a few tips which will help your develop a roadmap to the Rs 1-crore target.

Evaluate the present

Start by aligning your finances in the right direction. It is important that you know what is needed to save Rs 1 crore. Your entire financial world, from your pay to your expenditure to how much you invest and what you borrow, has to be considered. Most importantly while evaluating your target take into account realistic returns. One will set you back and other will take you forward; but if you ensure that you have smart targets, then you will get to keep these two on the same page.

Break up the financial target

It will help if you start by breaking up your financial goals. Start by subtracting how much you have currently saved it from Rs 1 crore. It will tell you the distance left to cover. Depending upon your age, income and expenses, you can work out how long it would take with the kind of investible surplus you have to reach your target. It will give you a reality check and three things would become clear.

# Whether the expectation of your future is realistic

# Whether you have to reduce the target

# If you will have to increase your disposable income to achieve your goals

Early Bird Catches The Worm

The pace at which a person builds his wealth is dependent on his income levels and his level of discipline. Rather than aiming to create substantial wealth, focus on leading a lifestyle that you can afford and save at least a quarter of your post-tax income for long-term growth. When your income levels start going up in percentage terms, your savings should grow at a rate higher than the growth in income. This way you will be able to capitalize on the power of compounding.

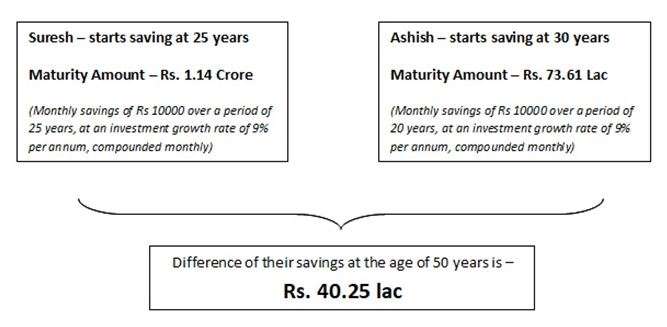

Let us look at this example: Ashish and Suresh, both 25 years, decide they need to save for their retirement. They both consult a financial advisor who tells them they need to put aside Rs 10,000 every month, in case they want to reach a target of Rs 1 crore up to the time they are 50.

But the little glitch here is that while Suresh starts saving immediately, Ashish starts saving after 5 years, i.e. at the age of 30.

Here’s how their portfolios have performed:

Ideally, the earlier one starts on building the corpus, the better it would be. For each year that you delay, the amount required to be invested every month to achieve the same target just keeps growing.

Build an action plan

Any such plan needs a time-frame. This will depend on the city that you live in, the size of your family and your sources of income. While multiple sources of income let you set aggressive saving targets, factors such as lifestyle and number of dependents let you set your expenses. The time-frame will also decide the instruments you choose depending on your risk appetite. If you have a substantial investment surplus and lots of time, you can be conservative in your choice of asset classes and still hit your target. The less of either you have, the more you will have to try to make up the deficit with aggressive investing and risk taking. The greater risk you will take, the more potential returns you can get.

-

Money2 weeks ago

Money2 weeks agoOld vs New Tax Regime: Key Differences & Which One to Choose in 2025

-

Education3 weeks ago

Education3 weeks agoTop 5 Scholarships Available for Indian Students in 2025

-

Money3 weeks ago

Money3 weeks agoHow Much Money Do You Need to Retire Early in India? A Comprehensive Guide

-

Money4 weeks ago

Money4 weeks ago7 Key Benefits of Hiring a Financial Advisor-Even If You’re Financially Secure

-

Health4 weeks ago

Health4 weeks ago5 Mistakes You Might Be Making While Eating Dry Fruits (and How to Fix Them)

-

Money2 weeks ago

Money2 weeks agoHow to Get a Low-Interest Home Loan: Insider Tips & Tricks

-

Money4 weeks ago

Money4 weeks ago5 Best Tax-Saver Bank Fixed Deposits to Consider in 2025

-

Money4 weeks ago

Money4 weeks agoMoney After Divorce: How Courts Calculate Alimony